American Rescue Plan

$1.9 trillion economic stimulus bill passed by the 117th United States Congress

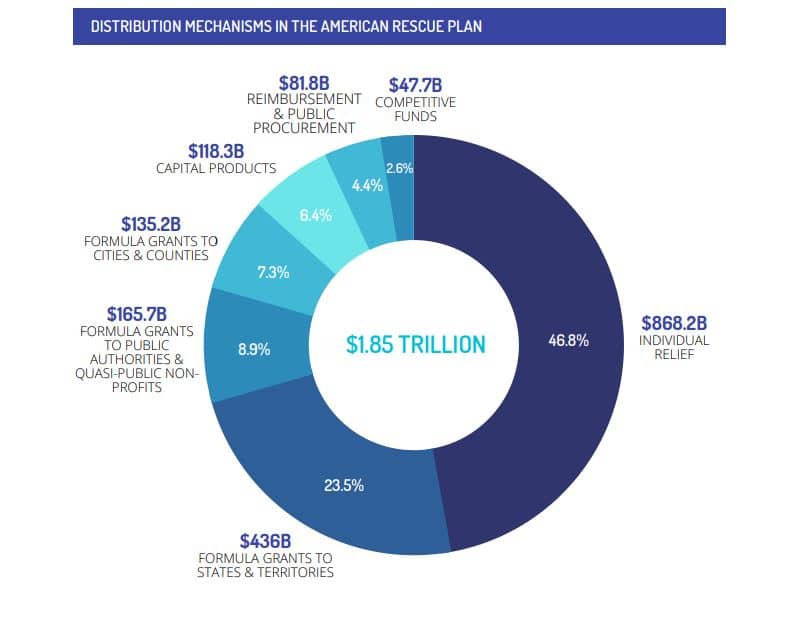

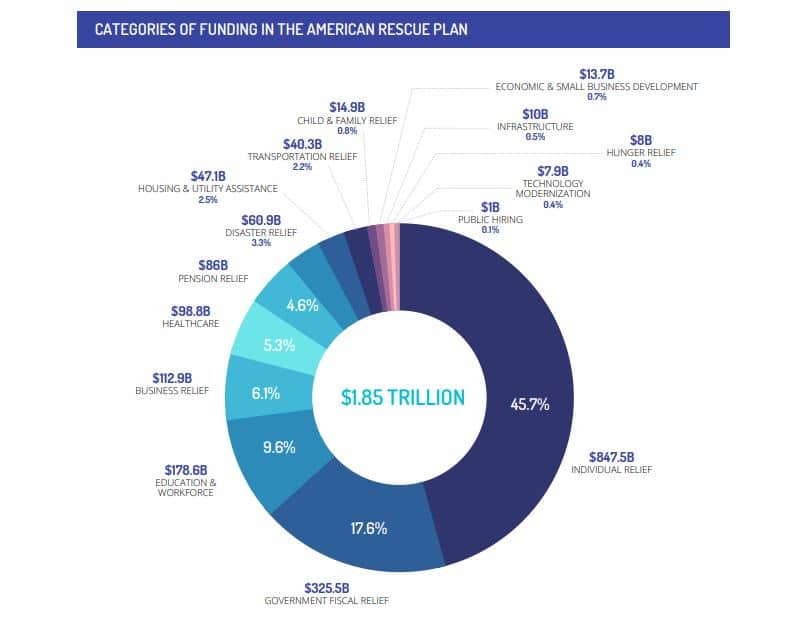

On March 11, 2021, President Biden signed the $1.9 trillion American Rescue Plan (ARP) into law. The Plan will deliver $350 billion for state, local, territorial, and Tribal governments to respond to the COVID-19 emergency and bring back jobs.

The Coronavirus State and Local Fiscal Recovery Funds provide a substantial infusion of resources to help turn the tide on the pandemic, address its economic fallout, and lay the foundation for a strong and equitable recovery.

Funding Objectives

• Support urgent COVID-19 response efforts to continue to decrease spread of the virus and bring the pandemic under control

• Replace lost public sector revenue to strengthen support for vital public services and help retain jobs

• Support immediate economic stabilization for households and businesses

• Address systemic public health and economic challenges that have contributed to the inequal impact of the pandemic

Read a summary of the $350 billion for state, local, territorial and tribal governments from the U.S. Department of the Treasury here.

The United States Conference of Mayors has produced a helpful guide called the American Rescue Plan Federal Investment Guide. Read the full guide here.

Paycheck Protection Program (PPP)

The Rescue Plan provides $7.25 billion to top-up the Paycheck Protection Program that was started under the CARES Act. Applicants may apply for a first or second draw forgivable loan. Eligibility details and local lenders can be found online via the SBA’s portal. Applications are open until March 31, 2021, but Congress is expected to pass legislation extending this deadline until late May. Read more here.

Targeted Emergency Injury Disaster Loan (EIDL) Advance

The Rescue Plan provides $15 billion to top-up the already-existing COVID-19 Targeted EIDL Advance. The Targeted EIDL Advance provides businesses in low-income communities with funds to ensure small business continuity, adaptation, and resiliency. Advance funds up to $10,000 will be available to applicants in low-income communities who previously received an EIDL Advance for less than $10,000 or those who applied but received no funds due to lack of available program funding. A $5 billion set-aside was carved out for Supplemental Targeted EIDL Advance payments for those hardest hit. Read more here.

State Small Business Credit Initiative

The American Rescue Plan provides $10 billion to state and tribal governments to fund small business credit expansion initiatives. This program will build off of the inaugural model developed in 2011 during the Obama-Biden Administration in which nearly $1.5 billion in capital supported more than $8 billion in new lending and investing activity across 142 different programs in its first five years. The new iteration will expand in scale and will include: $1.5 billion for states to support businesses owned by socially and economically disadvantaged entrepreneurs; $1 billion for an incentive program to boost funding tranches for states that show robust support for these businesses; and $500 million to support very small businesses with fewer than ten employees. This law will inject capital into state small business support and capital access programs, provide collateral support, facilitate loan participation, and enable credit guarantee programs. Read more here.

Business Relief

Restaurant Revitalization Fund

The Rescue Plan provides $28.6 billion to establish the Restaurant Revitalization Fund to provide tax-free federal grants to food and beverage businesses hit hard by the pandemic. These grants may be applied to eligible expenses already incurred and for additional expenses over the remainder of the year, and they are available to entities ranging from food carts to full-service restaurants and tasting rooms. Applications are not yet available and guidance is likely forthcoming. Funds will remain available until expended. Read the most up-to-date information here.

Apply through the SBA Portal.

Shuttered Venue Operator Grants

The Rescue Plan builds on the Shuttered Venue Operators Grant program established in the December 2020 CCRRSA, which allocated $16 billion. The ARP adds an additional $1.25 billion in grants to shuttered venues. Eligible applicants may qualify for grants equal to 45% of their gross revenue, up to $10 million. Eligible entities include: live venue operators or promoters; theatrical producers; live performing arts organization operators; museum operators; zoos and aquariums who meet specific criteria; motion picture theater operators; talent representatives; and each business entity owned by an entity that meets eligibility requirements. Businesses must have been in operation as of February 29, 2020, and venues or promoters who received a PPP loan on or after December 27, 2020 will have their venue grant reduced by the loan amount. SBA is building the grant program and expects to open applications in early April. Those who have suffered the greatest economic loss will be the first applications processed. Read more here.

COVID-19 Arts Organization Relief

The Rescue Plan provides funds to cover up to 100% of the costs of general administrative expenses, operating costs, and programs to prevent, prepare for, respond to, and recover from the pandemic. 40% of funds will go to state arts agencies and regional arts organizations. 60% will be awarded through a competitive grant process to support arts organizations of all sizes, complementary to the Shuttered Venues SBA program. Read more here.

COVID-19 Humanities Organization Relief

The Rescue Plan provides funds to cover up to 100% of the costs of general administrative expenses, operating costs, and programs to prevent, prepare for, respond to, and recover from the pandemic. 40% of funds will go to state humanities councils. 60 % of funds will be awarded through a competitive grant process to cultural organizations of all sizes including museums, libraries, historic sites, archives, and educational institutions. Read more here.

Competitive Funds

COVID-19 Related Manufacturing R&D

The Rescue Plan provides $150 million to the National Institute of Standards and Technology. These funds will be available until September 30, 2022 to fund awards for research, development, and testbeds to prevent, prepare for, and respond to the pandemic, including through NIST’s network of manufacturing research institutes. None of these funds are subject to

cost share requirements. Details are forthcoming. The grant application will be posted here.

COVID-19 Related R&D

The Rescue Plan provides $600 million to the National Science Foundation to remain available until September 30, 2022. This money will fund or extend new and existing research grants, cooperative agreements, scholarships, fellowships, apprenticeships, and related administrative expenses to prevent, prepare for, and respond to the pandemic. Applications will be posted on NSF website and grants.gov.

COVID-19 Humanities Organization Relief

The Rescue Plan provides funds to cover up to 100% of the costs of general administrative expenses, operating costs, and programs to prevent, prepare for, respond to, and recover from the pandemic. 40% of funds will go to state humanities councils. 60 % of funds will be awarded through a competitive grant process to cultural organizations of all sizes including museums, libraries, historic sites, archives, and educational institutions. Read more here.

COVID-19 Arts Organization Relief

The Rescue Plan provides funds to cover up to 100% of the costs of general administrative expenses, operating costs, and programs to prevent, prepare for, respond to, and recover from the pandemic. 40% of funds will go to state arts agencies and regional arts organizations. 60% will be awarded through a competitive grant process to support arts organizations of all sizes, complementary to the Shuttered Venues SBA program. Read more here.

Individual Relief

Unemployment Insurance and UI Tax Exemption

The Rescue Plan continues the existing $300 weekly boost in federal unemployment benefits and two key pandemic unemployment programs through September 6. The Pandemic Unemployment Assistance program provides benefits to the self-employed, gig workers, independent contractors, and other workers affected by the pandemic who do not qualify for state-level assistance. The Pandemic Emergency Unemployment Compensation program increases the duration of payments for those in the traditional state unemployment system. The first $10,200 in benefits will be tax-free for households with annual incomes less than $150,000.

Child Tax Credit and EITC Expansion

The Rescue Plan increases the Child Tax Credit maximum amount to $3,000 per child and $3,600 for children under age six. It also extends the credit to 17-year-olds. The increase in the maximum amount phases out at $150,000 in income for married couples, $112,500 for heads of households, and $75,000 for other parents. The ARP also makes the Child Tax Credit fully refundable, meaning the entire credit could be provided as a refund if it exceeds an individual’s income tax liability, instead of partially refundable under current law. Credit amounts will be made through advance payments during 2021 from July to December. It also raises the EITC for adults without children from $543 to $1,502 and lowers the age eligibility for the childless EITC from 25 to 19. It also eliminates the upper age limit, whi ch currently bars the credit for childless people who are 65 and older. Read more here.

Rental Assistance for Rural, Low-Income, and Elderly Borrowers

The Rescue Plan provides $100 million through September 2022 in rental assistance for rural, low-income and elderly borrowers. This funding is available to support unassisted households living in USDA-subsidized properties and who are struggling to pay rent during the pandemic. Read more here.

Expansion of the Families First Coronavirus Response Act (FFCRA)

The Rescue Plan extends the FFCRA Tax Credit for voluntary leave provided by employers through the third quarter of 2021 and increases the maximum allowable credit to $12,000 per employee. The ARP also restarts the 10-day clock, allowing employers who claimed the credit with respect to an employee in 2020 to claim the credit with respect to qualifying wages paid to the same employee in 2021. It also extends the situations under which qualifying sick leave may be taken to include situations where an employee is awaiting a COVID-19 test or is selfquarantining, getting vaccinated for COVID-19, or recovering from any injury, disability, illness, or condition related to COVID-19 vaccination. The ARP also allows governmental entities that are corporations with a separate tax-exempt status and state colleges, universities, and hospitals to claim the FFCRA Tax Credit. Read more here.

Expansion of Employee Rentention Credit (ERC)

The Rescue Plan extends the ability of businesses and non-profit organizations to receive a refundable credit against Social Security taxes equal to 70% (an increase from 50%) of “qualified wages” paid to their employees during the COVID-19 crisis. It targets businesses that were fully or partially shut down because of the crisis or saw gross receipts 80% or less of those seen in the same quarter in 2019, and it generally applies to those who did not apply for PPP loans. The ARP offers special provisions to startups with with annual gross receipt s less than $1 million. Read more here.

Additional Expanded Individual Tax Credits

The American Rescue Plan extends a number of critical tax benefits to individuals. These include: (1) expanding the premium tax credit for the Affordable Care Act, and; (2) expanding Child and Dependent Care Tax Credits from $5,000 to $10,050 for married couples. Read more here.

Housing and Utility Assistance

Homeowners Assistance Fund

$9.6 Billion for for states, territories, and tribes to provide relief for vulnerable homeowners. This includes: a minimum of $50 million for each state, the District of Columbia, and Puerto Rico, and; $30 million for territories. The law prioritizes homeowners who have experienced the greatest hardships, leveraging local and national income indicators to maximize intended impact. Funds can be used to make delinquent mortgage payments. Funds will remain available until September 30, 2025. Read more here. Read more here.

Housing and Utility Assistance

$5 Billion that will enable HUD to provide emergency housing vouchers dedicated for individuals and families who are experiencing homelessness or at-risk of homelessness. These funds will be provided through Section 8 housing vouchers. Funds will be available until September 30, 2030. Read more here.

Veterans Relief

Veterans Healthcare Debt Relief

The Rescue Plan provides $1 billion for debt forgiveness related to copayments or other cost sharing that veterans paid for VA healthcare and to reimburse veterans who paid a copay or other cost sharing for care and prescriptions provided from April 6, 2020 through September 30, 2021. Read more here.

Veterans Workforce Rapid Retraining

The Rescue Plan provides $386 million to establish a COVID–19 Veteran Rapid Retraining Assistance Program that will offer 12 months of non-college training, housing support, and employment assistance for unemployed veterans between the ages of 22 and 67. The program is intended to serve nearly 17,250 eligible veterans. Funding is effective immediately and available through December 2022. Read more here.

COVID-19 Resources

Explore business and employee resources that will help you navigate these uncertain times.

Invest in Sarasota County

The EDC of Sarasota County diversifies our local economy and helps create jobs for Floridians. Investing in the EDC empowers us to grow our economy and attract more business to our region.

Latest News

Ringling College of Art and Design launches AI undergraduate certificate program

Ringling College's new Artificial Intelligence Undergraduate Certificate program is the first of...

How Nucleus Security’s $43M Series B Funding Powers Enterprise Risk-Based Vulnerability Management Innovation

Nucleus is a Risk Based Vulnerability Management (RBVM) solution that automates vulnerability...

EDC of Sarasota County’s President & CEO Named One of North America’s Top 50 Economic Developers

Consultant Connect, a national consulting firm focusing on strengthening partnerships between...