COVID-19 for Employers

Find helpful information and resources available for Sarasota County employers to address COVID-19 challenges.

This page is for informational purposes only. This page does not imply endorsement of any particularl program/organization. We will update the information often, but because the situation is quickly evolving some of this information may have changed. To provide feedback please email info@edcsarasotacounty.com.

For COVID-19 text updates from Sarasota County Government, text SRQCOVID19 to 888777. Visit this link for the most up-to-date announcements from the Sarasota County Government. The Sarasota Health Department has established a COVID-19 call center for Sarasota County residents who believe they may have Coronavirus (COVID-19). The number is 941-861-2883. Subject-matter experts are on duty 8am-5pm, Monday-Friday.

For the most up-to-date information about COVID-19 statewide, please visit the Florida Department of Health’s dedicated COVID-19 webpage. The Florida Department of Health hosts a new COVID-19 Case Dashboard. To keep Florida residents and visitors safe, informed and aware about the status of the virus, this dashboard will be updated twice daily. For any other questions related to COVID-19 in Florida, please contact the state’s dedicated COVID-19 Call Center by calling (866) 779-6121. The Call Center is available 24 hours per day. Inquiries may also be emailed to COVID-19@flhealth.gov.

On This Page

- Paycheck Protection Program (PPP)

- Economic Injury Disaster Loan (EIDL)

- Small Business Debt Relief Program

- Employee Retention Tax Credit

- SBDC Emergency Bridge Loan

- SBA Economic Injury Disaster Loan

- Main Street Lending Program

- Short-Time Compensation Program

- Families First Coronavirus Response Act

- Sales and Use Tax Relief

- IRS Tax Relief for Businesses and Tax-Exempt Entities

- FPL Main Street Recovery Credit Program

- JBF Micro-Grants for Independent Food/Beverage Businesses

Paycheck Protection Program

PPP Second draw application can be found here

The Paycheck Protection Program provides cash-flow assistance through 100% federally guaranteed loans to employers who maintain their payroll during this emergency. If employers maintain their payroll, the loans would be forgiven, which would help workers remain employed, as well as help affected small businesses and our economy snap-back quicker after the crisis.

Economic Injury Disaster Loan

Applicants who have already submitted their applications will continue to be processed on a first-come, first-served basis. Find your local SBA District Office

Economic Injury Disaster Loan Advance Information

The SBA’s Economic Injury Disaster Loan program provides small businesses with working capital loans that can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing. Loans may be used to pay fixed debts, payroll, accounts payable and other bills that can’t be paid because of the disaster’s impact. The interest rate is 3.75% for small businesses without credit available elsewhere; businesses with credit available elsewhere are not eligible. The interest rate for non-profits is 2.75%. Loans have long-term repayments in order to keep payments affordable, up to a maximum of 30 years. Terms are determined on a case-by-case basis, based upon each borrower’s ability to repay. For additional information, please contact the SBA Disaster Assistance Customer Service Center: 1-800-659-2955 (TTY: 1-800-877-8339) or disastercustomerservice@sba.gov.

Ways to Connect with SBA South Florida:

Website: www.sba.gov/southflorida

Email: SouthFlorida_DO@sba.gov

Small Business Debt Relief Program

Express Bridge Loan Pilot Program allows small businesses who currently have a business relationship with an SBA Express Lender to access up to $25,000 with less paperwork. These loans can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing and can be a term loans or used to bridge the gap while applying for a direct SBA Economic Injury Disaster loan. If a small business has an urgent need for cash while waiting for decision and disbursement on Economic Injury Disaster Loan, they may qualify for an SBA Express Disaster Bridge Loan. Terms: Up to $25,000, Fast turnaround, Will be repaid in full or in part by proceeds from the EIDL loan.

Employee Retention Tax Credit

This employee retention tax credit is a tax credit for compensation, including the employer portion of health benefits, for each eligible employee. Compensation does not include paid sick or family leave for which the employer is reimbursed under the Families First Coronavirus Response Act.

SBDC Emergency Bridge Loan

The Florida Small Business Emergency Bridge Loan Program is short-term, interest-free working capital loans that are intended to “bridge the gap” between the time a major catastrophe hits and when a business has secured longer term recovery resources, such as sufficient profits from a revived business, receipt of payments on insurance claims or federal disaster assistance.

For questions regarding the Emergency Bridge Loan Program, please contact the Florida Small Business Development Center (SBDC) Network Headquarters. Email: USF@floridasbdc.org (preferred method of contact). Phone: Regional SBDC Office at (813)905-5800.

SBA Economic Injury Disaster Loan

The SBA’s Economic Injury Disaster Loan program provides small businesses with working capital loans that can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing. The U.S. Small Business Administration is currently only accepting Economic Injury Disaster Loan (EIDL) and EIDL Advance applications on a limited basis for agricultural businesses. Additionally, the maximum loan amounts have been capped at $150,000.

Loans may be used to pay fixed debts, payroll, accounts payable and other bills that can’t be paid because of the disaster’s impact. The interest rate is 3.75% for small businesses without credit available elsewhere; businesses with credit available elsewhere are not eligible. The interest rate for non-profits is 2.75%. Loans have long-term repayments in order to keep payments affordable, up to a maximum of 30 years. Terms are determined on a case-by-case basis, based upon each borrower’s ability to repay. For additional information, please contact the SBA Disaster Assistance Customer Service Center: 1-800-659-2955 (TTY: 1-800-877-8339)

or disastercustomerservice@sba.gov.

The loan advance will provide economic relief to businesses that are currently experiencing a temporary loss of revenue. Funds will be made available within three days of a successful application, and this loan advance will not have to be repaid.

Ways to Connect with SBA South Florida:

Website: www.sba.gov/southflorida

Email: SouthFlorida_DO@sba.gov

Main Street Lending Program

The Main Street Lending Program is designed to provide support to small and medium-sized businesses and their employees across the United States during the current period of financial strain by supporting the provision of credit to such businesses. The availability of additional credit is intended to help companies that were in sound financial condition prior to the onset of the COVID-19 pandemic maintain their operations and payroll until conditions normalize. Small and medium-sized businesses are integral to the U.S. economy and create jobs for a large share of the U.S. workforce.

The program is designed to help credit flow to small and medium-sized businesses that were in sound financial condition before the onset of the COVID-19 crisis, but now need loans to help maintain their operations until they have recovered from, or adapted to, the impacts of the pandemic.

Loans originated under the program have several features that will help businesses facing challenges. The program offers 5-year loans, with floating rates, and principal and interest payments deferred as indicated in the chart below to assist businesses facing temporary cash flow interruptions. The loans range in size from $250,000 to $300 million – a wide range that may support a broad set of employers.

Short-Time Compensation Program

The Short-Time Compensation Program is a voluntary employer program designed to help employers maintain their staff by reducing the weekly working hours during temporary slowdowns instead of temporarily laying off employees. Short-Time Compensation (STC) permits pro-rated Reemployment Assistance (RA) benefits to employees whose work hours and earnings are reduced as part of a STC plan to avoid total layoff of some employees. If an employer establishes a Short-Time Compensation Plan and an employee meets the qualifications to file a reemployment assistance claim in the state of Florida, the employee will receive a partial reemployment check to supplement their reduced paycheck.

-

Employer Role

To apply for the Short-Time Compensation Program (required for employees to submit a reemployment claim), please follow this link to the Employer Login page of CONNECT. Read more information for employers here.- As an employer, you must complete a Short-Time Compensation Plan application. A Short-Time Compensation Plan lasts for one year but can be renewed if your employees have returned to full-time work during the plan year.

- At least 10% (not less than 2) of your employees in your total staff or in a particular department must work reduced hours.

- Employers must certify that they will reduce the employees normal number of weekly work hours by 10%, but no more than 40%.

- The employees in the affected units must be identified by name and social security number.

- Employers must name the employee participating in the program and must provide the Department of Economic Opportunity with the employee’s normal weekly hours (excluding overtime).

- The situation must be temporary rather than a temporary layoff.

- Employee Role

- You must be a full-time employee, (not part-time or seasonal) with a standard number of hours worked each week (excluding overtime). You must meet all of the normal requirements to establish a Florida reemployment claim and you must provide the Department of Economic Opportunity with any necessary information or documentation.

- While on the Short-Time Compensation program you must work and/or receive paid leave for ALL of the hours that your employer has you scheduled to work in order to receive Short-Time Compensation Benefits for a week.

- Every two weeks you will be required to report your hours worked, plus any hours of paid leave from your Short-Time Compensation employer and if you have a part-time job, earnings from that part-time job.

- Employees must work at least 60%, but no more than 90% of their normal work hours, to qualify for STC benefits.

- Benefits

- Employees are spared the hardships of full unemployment, and employers retain employees who can resume high production levels when business conditions improve.

- Employers avoid the expense of recruiting, hiring, and training new workers when business conditions improve.

- Affected employees may continue to work at reduced levels with an opportunity to find other employment before the expected layoff.

Families First Coronavirus Act

This new law takes effect April 2, 2020. It requires employers with up to 500 employees to provide paid sick leave and paid family leave while also providing a refundable payroll tax credit to employers to cover 100% of the cost of wages. Read the full act here.

The U.S. Department of Labor’s Wage and Hour Division (WHD) published its first round of implementation guidance pursuant to the Families First Coronavirus Response Act (FFCRA). The guidance addresses critical questions such as:

How does an employer count its number of employees to determine coverage?

How can small businesses obtain an exemption?

How does an employer count hours for part-time employees?

How does an employer calculate wages employees are entitled to under the FFCRA?

Read more…

Sales and Tax Relief

On Monday, March 16, 2020, Governor Ron DeSantis directed the Department of Revenue (Department) to provide flexibility on tax due dates, such as sales tax, to assist those adversely affected by COVID-19. Sales and use tax, as well as other related tax returns and payments, are normally due on the first day of the month and are late after the twentieth day of the month. Order of Emergency Waiver/Deviation #20-52-DOR-002 outlines:

- Taxpayers who have been adversely affected by COVID-19, have an extended due date to April 30, 2020, for sales and use tax, as well as other related taxes, collected in March.

- Taxpayers who have not been adversely affected by COVID-19 continue to file and remit taxes no later than the normal due date of April 20.

- Taxpayers who were unable to meet the March 20 due date will have penalty and interest waived for taxes collected in February if the taxes are reported and remitted by March 31, 2020.

Adversely affected taxpayer means:

- The business closed in compliance with a state or local government order and had no taxable sales transactions as a result; or

- The business experienced sales tax collections in March 2020 that are less than 75% of March 2019 sales tax collections; or

- The business was established after March 2019; or

- The business is registered with the Department to file quarterly.

For taxpayers who have additional questions, the Department has established a dedicated team to address tax-related issues pertaining to COVID-19 and created an email address, COVID19TAXHELP@floridarevenue.com. For more information or to sign up for email updates from the Department of Revenue, visit floridarevenue.com.

IRS Tax Relief for Businesses and Tax-Exempt Entities

Get information on coronavirus (COVID-19) tax relief for businesses and tax-exempt entities like:

- Filing and Payment Deadline Extended

- Employee Retention Credit

- Coronavirus-Related Paid Leave for Workers and Tax Credits for Small- and Mid-Size Businesses

- Online Tax Help

- Online resources for tax exempt and other entities

FPL’s Main Street Recovery Credit Program

To help boost small businesses.

Eligible establishments:

- Non-demand commercial account- To determine if you have a non-demand or demand commercial account, please see the new charges section of your bill

- New small businesses – Starting service on or after December 1, 2020

- Small businesses that were inactive for at least 6 months -Existing accounts with 0 kWh usage for at least 6 consecutive months after March 2020

- Existing small businesses operating in communities designated as federal Opportunity Zones

Program benefits

- Support the operation and development of small business customers

- Receive a monthly 10% credit based on the prior month’s energy charge portion of bill for the duration of the program

How to apply and what to expect

- Fill out the application here

- The program is planned to run through December 2021

JBF Micro-Grants for Independent Food/Beverage Businesses

To help bring swift economic relief to these essential businesses, the Foundation launched a fund that will be gathering support from corporate, foundation, and individual donors to provide micro-grants to independent food and beverage businesses in need. If you are inquiring about criteria in the application process for the JBF Food and Beverage Industry Relief Fund, please submit your information through this form. Application materials are being created at this time and more information will be sent out when it is ready.

Paycheck Protection Program

The U.S. Chamber of Commerce has produced a helpful Small Business Guide and Checklist to help you understand the Paycheck Protection Program (PPP) created by the CARES Act,

How Can We Help?

Contact Destin Wells, VP of Business Development, to see how we can help you thrive in Sarasota County.

Invest in Sarasota County

The EDC of Sarasota County diversifies our local economy and helps create jobs for Floridians. Investing in the EDC empowers us to grow our economy and attract more business to our region.

Latest News

EDC Edge | February 2024

To view EDC Edge | February 2024 via Constant Contact, click here. An Update From the...

Around the Chair Advisors Roundtable

Last week, several Investors joined the EDC of Sarasota County’s team for an exclusive Chair...

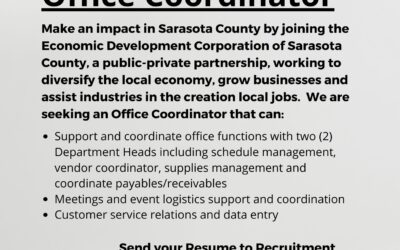

We’re Hiring!

Organization Overview The mission of the Economic Development Corporation of Sarasota County is to...